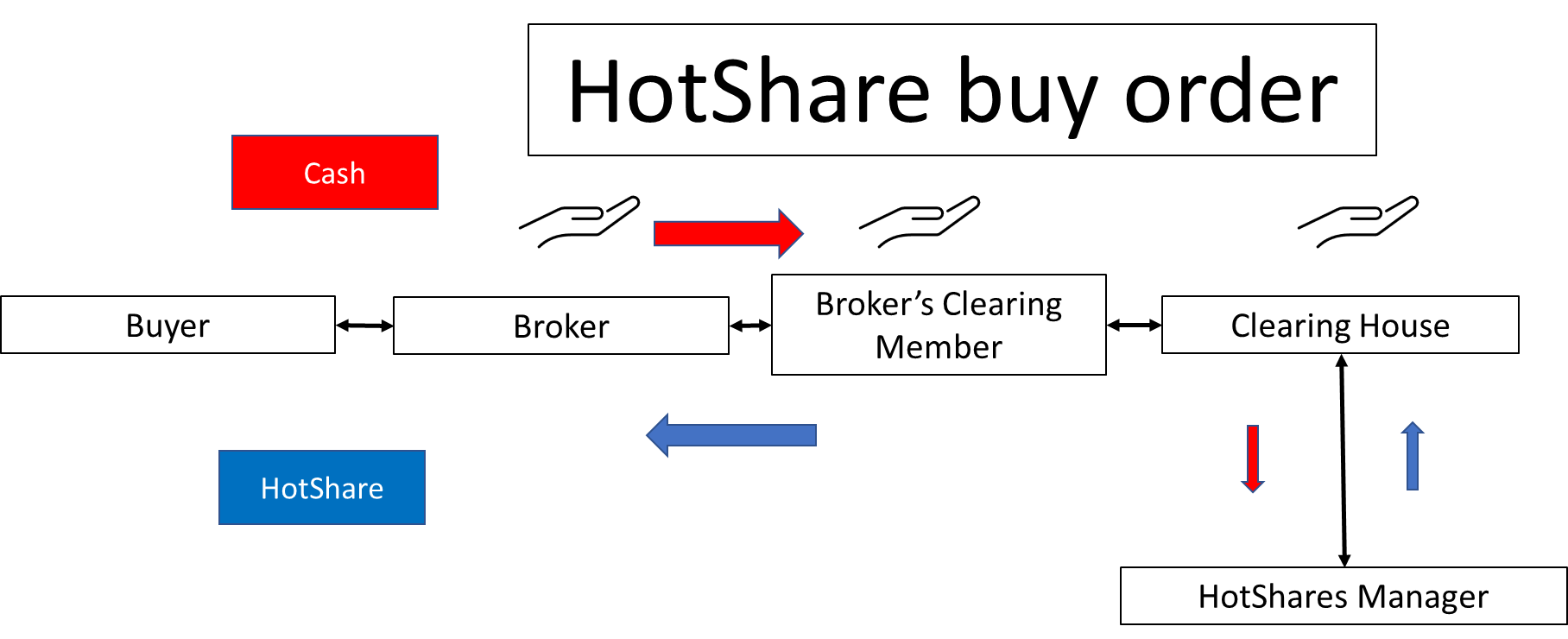

When you place an order with Wealthsimple, it is automatically sent to an executing broker. What happens when you place a trade on Wealthsimple However, these tiny profits on smaller orders add up, making it worth paying retail brokerages to have trades sent their way. The amount earned by market makers is often as small as a fraction of a penny and it compensates them for providing liquidity to the marketplace for retail investors, regardless of market conditions.

The spread is subject to price risk-meaning that the firm could lose money if the stock’s price moves in an unfavorable direction compared to the position they hold. The difference between the price at which a market maker buys a security and sells it (or vice versa) is known as the spread. Market makers earn revenue by taking on the short-term risk that they can sell a security at a price higher than they bought it, and vice versa. In some cases, market makers will compensate brokerages for routing orders to them, otherwise known as Payment For Order Flow. Who are market makers and why do they pay for order flow?Ī market maker refers to a firm who actively posts bids and offers on a particular security in the market and buys and sells securities for its own account. Payment for Order Flow (PFOF) is a form of compensation, usually fractions of a penny per share, that a brokerage may receive for sending their orders to entities known as market makers. As your brokerage, we have an obligation to provide you with the best execution possible. Note: Payment for Order Flow does not result in any additional charges for our clients.

0 kommentar(er)

0 kommentar(er)